mississippi auto sales tax calculator

The exact taxable value will vary for your vehicle based on the MSRP and the available state tax incentives. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles.

Registration fees are 1275 for renewals and 1400 for first time registrations.

. Sales Tax calculator Mississippi. 425 Motor Vehicle Document Fee. Tax and Tags Calculator.

Sales and Gross Receipts Taxes in Mississippi amounts to 53 billion. Home Motor Vehicle Sales Tax Calculator. During the year to deduct sales tax instead of income tax if.

Because of this tax rates are exclusively between 5 and 6 with an average of 5065. Ad Lookup Sales Tax Rates For Free. Sections 27 65 17 27 65 20 27 65 25 the following are subject to sales tax equal to 7 of the gross proceeds of the retail.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Registration and Plating Fees in MISSISSIPPI. You can find these fees further down on the page.

Maximum Possible Sales Tax. Motor vehicle titling and registration. 775 for vehicle over 50000.

You can calculate the sales tax in Mississippi by multiplying the final purchase price by 05. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Interactive Tax Map Unlimited Use.

Maximum Local Sales Tax. For example lets say that you want to purchase a new car for 30000 you would use the following formula to calculate the sales tax. All vehicles sold in Mississippi are subject to the state tax rate of 5.

Car tax as listed. The county the vehicle is registered in. In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle.

A large number of counties in the Magnolia State do not levy any local taxthese county and local governments have the ability to include a 1 tax on car sales but many choose not to. 30000 x05 1500. Mississippi has a 7 statewide sales tax rate but also has 142 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0065 on.

The state in which you live. Tax on a casual sale is based on the assessed value of the vehicle as determined by the most recent assessment schedule. Mississippi DMV registration fees are about.

For additional information click on the links below. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. New car sales tax OR used car sales tax.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied.

Sales and Gross Receipts Taxes in Mississippi amounts to 53 billion. The exact taxable value will vary for your vehicle based on the MSRP and the available state tax incentives. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

The type of license plates requested. In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees. Before-tax price sale tax rate and final or after-tax price.

Average Local State Sales Tax. 635 for vehicle 50k or less. Motor Vehicle Licensing main page Motor Vehicle Assessments rule.

Mississippi State Sales Tax. Motor Vehicle Ad Valorem Tax Reduction Fund Legislative Tag Credit In order to provide a tax break to the registered owners of Mississippi motor vehicles the 1994 Mississippi Legislature authorized a credit to the owners in the amount of 5 of the assessed value of the motor vehicle. Mississippi Vehicle Tax Calculator.

It is 6499 of the total taxes 81 billion raised in Mississippi. For vehicles that are being rented or leased see see taxation of leases and rentals. Whether or not you have a trade-in.

Just enter the five-digit zip code of the. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city county. Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200.

635 for vehicle 50k or less. How to Calculate Mississippi Sales Tax on a Car. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

How To Calculate Income Tax In Excel

This Fuel Consumption Calculator Is An Excel Template To Calculate Average Cost And Mileage Per Liter Over Specific Period Excel Templates Book Template Excel

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

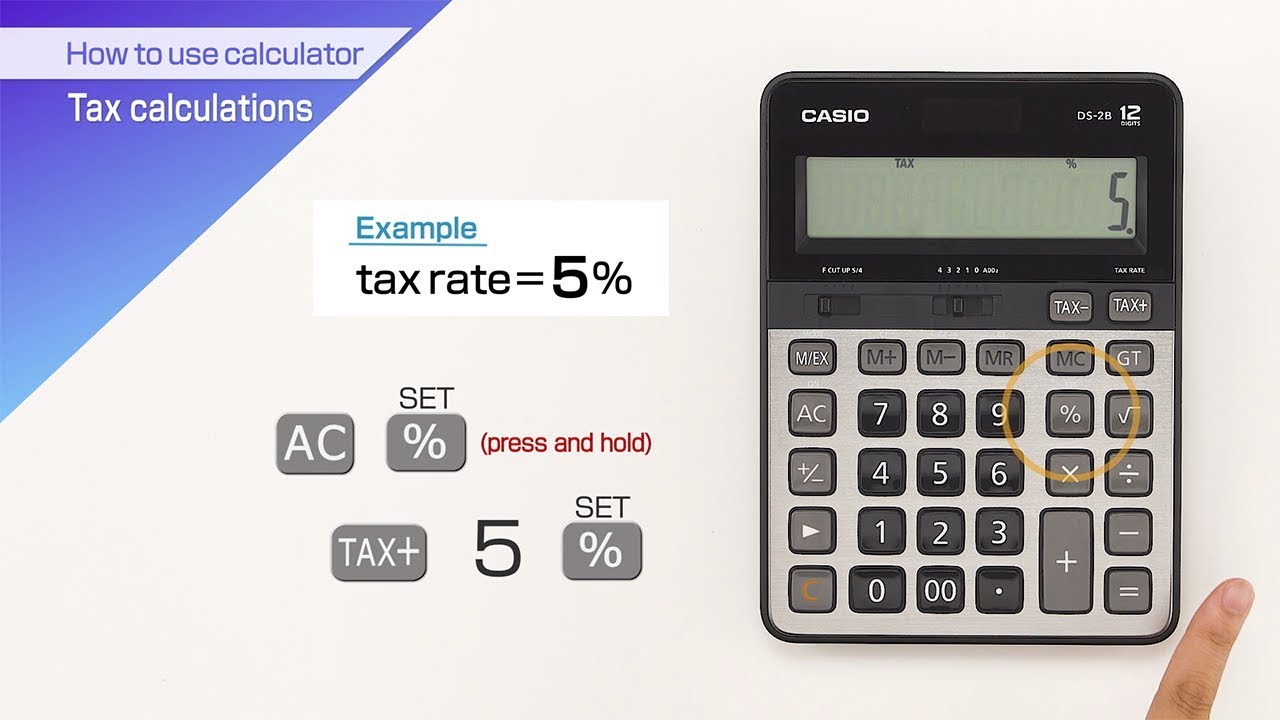

Casio Df 120fm 12 Digit Desktop Calculator Desktop Calculator Calculator Casio

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Sales Tax In Excel Tutorial Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

15 Ms Excel Calculator Templates For Everyone Loan Calculator Car Loan Calculator Home Equity Loan Calculator

How To Calculate Sales Tax In Excel

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Bookkeeping Templates Agenda Template

Car Tax By State Usa Manual Car Sales Tax Calculator