illinois payroll withholding calculator

Illinois Hourly Paycheck Calculator. 2022 Federal Tax Withholding Calculator.

Payroll Paycheck Calculator Wave

Illinois State Disbursement Unit.

. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you. Get Started With ADP Payroll.

Free Unbiased Reviews Top Picks. The calculator on this page is provided through the adp. This is a projection based on information you provide.

Illinois Withholding Tax Tables Illinois Income Tax withholding at 495 percent 0495 Based on allowances claimed on Form IL-W-4 Illinois Withholding Allowance Certificate Daily. Ad Process Payroll Faster Easier With ADP Payroll. Supports hourly salary income and multiple pay frequencies.

This is a projection based on information. Free Unbiased Reviews Top Picks. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator.

The illinois paycheck calculator is designed to help you understand your financial situation and determine what you owe in taxes. Ad Compare This Years Top 5 Free Payroll Software. Ad Process Payroll Faster Easier With ADP Payroll.

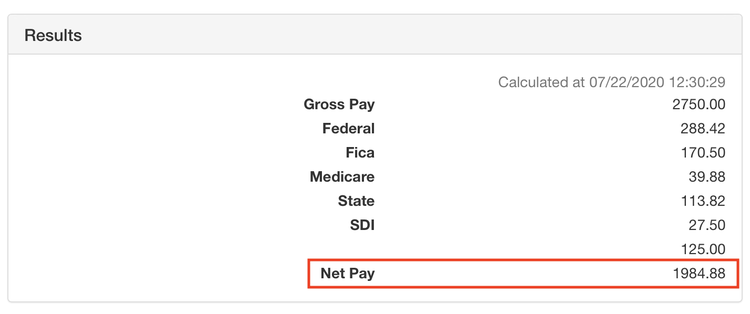

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Additional payroll withholding resources. Below are your Illinois salary paycheck results.

SERS Contact Information 2101 S. This free easy to use payroll calculator will calculate your take home pay. Free Federal and Illinois Paycheck Withholding Calculator.

Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. This is a projection based on information you. Carol Stream IL 60197-5400.

Just enter the wages tax withholdings and other information required. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Illinois child support payment information.

Find 10 Best Payrolling Services System 2022. Illinois Hourly Paycheck Calculator Results. 2022 Federal Tax Withholding Calculator.

2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Discover ADP Payroll Benefits Insurance Time Talent HR More. The wage base is.

Deducts the child support withholding from the employees wages. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. This calculator is a tool to estimate how much federal income tax will be withheld.

Paycheck Results is your gross pay and. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our.

Ad Compare This Years 10 Best Payroll Services Systems. Improve the accuracy and efficiency of payroll non-wage and unemployment tax management. If the income is paid biweekly multiply the minimum wage times 60 60 x 825 495.

Get Started With ADP Payroll. Ad See how tax withholding solutions from Sovos improve accuracy and efficiency. Illinois Payroll Withholding Effective January 1 2022.

Ad Compare This Years Top 5 Free Payroll Software. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Discover ADP Payroll Benefits Insurance Time Talent HR More.

This is a projection based on information you provide. Remit Withholding for Child Support to. All amounts are annual unless otherwise noted.

The results are broken up into three sections. Instead you fill out Steps 2 3. Free Unbiased Reviews Top Picks.

Free Unbiased Reviews Top Picks.

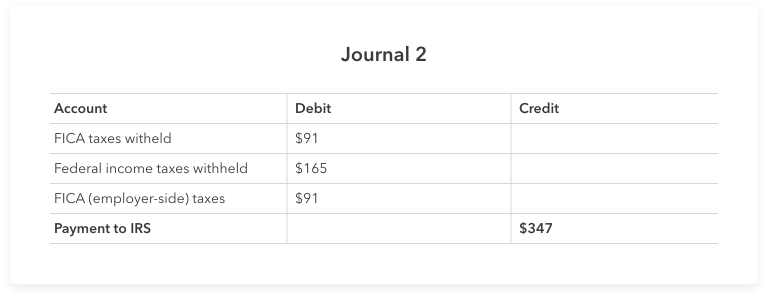

A Small Business Guide To Doing Manual Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Get An Accounting Job With No Experience Comptabilite D Entreprise Le Contrat De Travail Bourse

Setting Up Sales Tax In Quickbooks Online

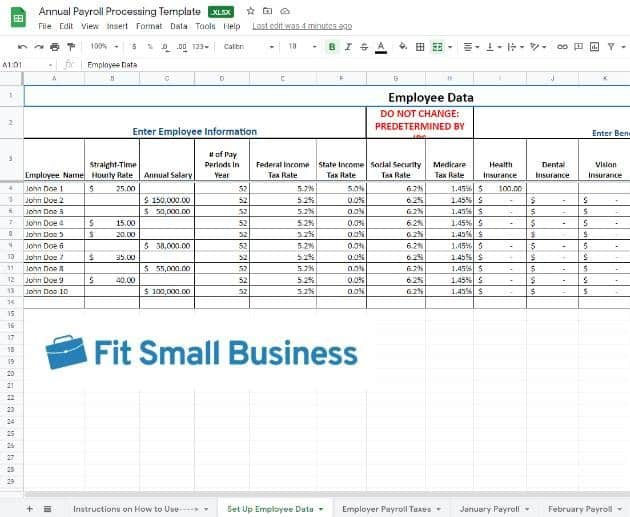

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Do Payroll In Excel In 7 Steps Free Template

Commercialista Milano Tax Accountant Accounting Money Savvy

What Is Local Income Tax Types States With Local Income Tax More

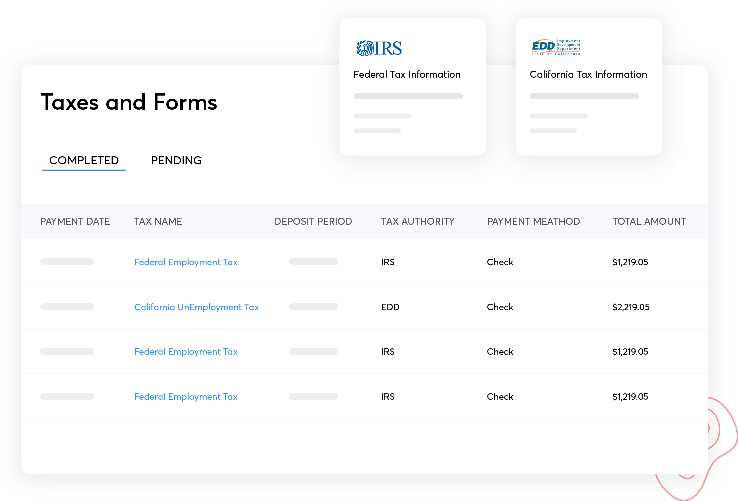

Online Payroll Software For Businesses Zoho Payroll

What Are Payroll Deductions Article

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax What It Is How To Calculate It Bench Accounting

![]()

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Illinois Paycheck Calculator Adp

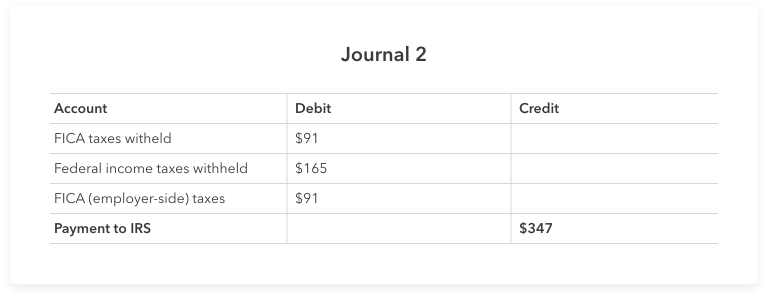

What Is Payroll Accounting A Guide For Small Business Owners Article

State Corporate Income Tax Rates And Brackets Tax Foundation